- How to withdraw money from cryptocom

- Best way to buy crypto

- Buy physical bitcoin

- When will all btc be mined

- Who has the most btc

- Time wonderland crypto

- Solana crypto price

- Dogecoin price today

- Cryptocurrency app

- When could you first buy bitcoin

- How much to buy dogecoin

- Cryptos

- Cryptocurrency exchanges

- Doge crypto

- Payment in cryptocurrency

- Shiba inu coin cryptocurrency

- Ohm crypto

- Safe dollar crypto

- Will crypto bounce back

- Does cryptocom charge fees

- Ethereum vs cardano

- Best crypto to buy

- New crypto coins

- How to fund crypto com account

- How to transfer from coinbase to cryptocom

- How to buy xrp on cryptocom

- Axs crypto

- Coinbase cryptocurrency prices

- Convert bitcoins to cash

- Where to buy bitcoin

- Cheapest crypto on crypto com

- Buy eth with btc

- Fiat wallet crypto

- Newest cryptocurrency on coinbase

- How much is bitcoin today

- Gala crypto

- How much is bitcoin

- How do you buy cryptocurrency

- Most viewed crypto

- Etc crypto

- Cryptocurrency prices

- Bitcoin futures

- Bitcoin price drop today

- Cryptocurrency bitcoin price

- Cryptocom unsupported currency

- How many btc are there

- To invest all profits in crypto

- Wallet for crypto

- Ethereum classic price history

- Apps cryptocurrency

- Bitcoin starting price

- Ethm price

- Cryptocom dogecoin

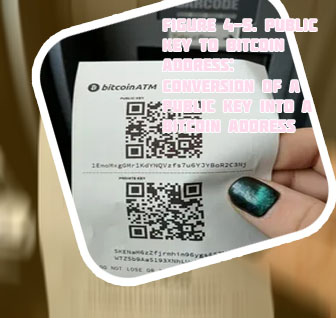

What are crypto keys

Is sweeping and importing keys the same thing?

As we mentioned earlier, keeping your private key safe is the most important part of making sure no one else has access to your Bitcoin. Never share your private key with anyone. Remember that for transactions, other people only need your public key or Bitcoin address. If possible, it’s a good idea to keep your private key offline rather than on a device that can be accessed via the internet. If you’re especially concerned about security, consider hardware wallets as an extra secure form of offline storage. The advantage here is that they can’t be hacked when you’re not entrusting your key to a third-party. Bitcoin key BitForex is a cryptocurrency exchange based in Singapore that was founded in 2018. It is a relatively new exchange but has gained popularity due to its user-friendly interface and low trading fees. BitForex offers a variety of cryptocurrencies and trading pairs, including Bitcoin, Ethereum, and Litecoin. The exchange also offers margin trading and futures trading.

Crypto key

SelfKey has three main components, which are the utility token KEY that powers the network, SelfKey wallet, and SelfKey marketplace. The SelfKey wallet is an integral part of the ecosystem and it serves the purpose of connecting users with their data and the SelfKey marketplace. Users can access their data within the wallet with utmost privacy, transparency, and security to use, manage, and store their identity information and private data. All data is available on the device where the wallet is installed. The SelfKey wallet is also the gateway to the SelfKey marketplace, so users can access various financial products and services. What is a private key? To determine if you can recover your lost Bitcoin wallet using a private key, you must first understand what type of wallet you have.

Recommended Articles

A discussion of bearer instruments or assets is applicable when evaluating the security of Bitcoin and other cryptocurrencies because cryptocurrency is a bearer asset: Whoever holds the private key is considered the owner. The blockchain enables self-custody of digital assets: the owner of crypto assets is free to choose from various wallet solutions, and the regulatory environment continues to shift. In some ways, every digital asset owner needs to become their own custodian, which can be frustrating when considering the security of those assets. All-time high / all-time low The term “cryptography” has Greek roots and originally meant “secret writing.” Over time, cryptography evolved from intelligence agencies and the military writing and decoding confidential messages and became a separate branch of computer science. Similar to the internet, the origins of cryptocurrencies can be traced back to academic and military use cases, which eventually expanded to the private sphere.